We have introduced multiple mechanisms to help you trade responsibly and manage risk better. īinance Futures offers many features and tools to make the most out of the cryptocurrency market. To add the EMA indicator to the price chart in the Binance App, go to and select a trading pair of your choice, click - and. It is important to note that prices can also slice through EMAs before a rebound or rejection occurs, just like traditional support and resistance levels. They are more dynamic than traditional horizontal support and resistance levels because they constantly change based on a given cryptocurrency’s most recent price action. Traders often use EMAs as support and resistance levels. This means that a golden cross and a death cross typically serve as confirmation of a trend reversal that has already happened – not a reversal that is still underway. It is worth noting that EMAs are lagging indicators with no predictive power. This event can provide possible trading opportunities as it usually anticipates the beginning of a new downtrend.

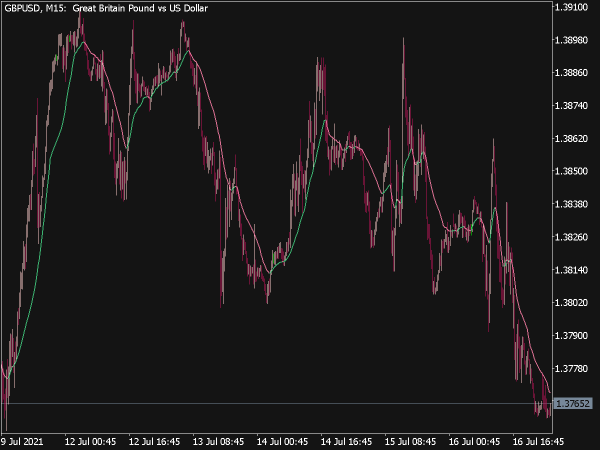

It develops after a prolonged uptrend when profit-taking intensifies and prices start decreasing. On the other hand, a death cross occurs when the 50 EMA crosses below the 200 EMA, which traders usually interpret as a bearish signal. This event can provide possible trading opportunities as it usually anticipates the beginning of a new uptrend. It develops after a prolonged downtrend when selling is depleted and prices start increasing. Combined, these EMAs can help determine price strength or weakness.Ī golden cross occurs when the 50 EMA crosses above the 200 EMA, which traders usually interpret as a bullish signal. Golden Cross and Death Crossĥ0 and 200 are the most commonly used values for EMAs. Still, we will focus on some of the most basic applications and limitations. Traders can use EMAs to anticipate trend reversals and areas of support and resistance in several ways. Still, the former places more importance on a given cryptocurrency’s most recent price action, following prices more precisely than a corresponding SMA. The exponential moving average (EMA) is similar to the simple moving average (SMA) as both measure trend direction over time.

#Ema indicator how to

How to Use the Exponential Moving Average (EMA) To add the Bollinger Bands to the price chart in the Binance App, go to and select a trading pair of your choice, click - and. It is important to note that prices can continue to move further regardless of entering oversold or overbought conditions. These conditions can signal a possible trend reversal.

Essentially, when prices move below the lower band, a cryptocurrency has entered the oversold territory, and when prices move above the upper band, a cryptocurrency has entered the overbought territory. Traders can also use the Bollinger Bands to identify whether a cryptocurrency trades in oversold or overbought conditions. It is worth noting that the squeeze does not determine when volatility will increase or the direction of the potential price move. This event can provide possible trading opportunities as it is usually followed by a spike in volatility.

It denotes a period of consolidation that is identifiable when the bands come close together, constricting the price action of a given cryptocurrency. The squeeze might be one of the most significant reasons traders use the Bollinger Bands. This technical indicator helps anticipate periods of high volatility, as well as oversold and overbought conditions.Īlthough there are 22 rules to follow when using the Bollinger Bands as a trading system, we will focus on some of the most basic applications and limitations. The Bollinger Bands were developed and copyrighted by financial analyst and trader John Bollinger in the early 1980s. So let’s explore how you can use the Bollinger Bands and exponential moving average (EMA) to gain additional insights into the price action of cryptocurrencies. Our goal is to help our users minimize risk while helping them anticipate trend reversals that can provide possible trading opportunities. These tools translate historical price action, volume, and even open interest data into simple, easy-to-read signals that aim to forecast the market’s direction.īinance Futures offers a wide range of indicators allowing traders to interpret cryptocurrency market data. Traders often rely on technical indicators to understand when to enter or exit a trade. Traders can use these indicators to anticipate trend reversals in the cryptocurrency market.īinance Futures offers a wide range of features and tools that allow you to analyze cryptocurrencies’ price action to make the most out of your trades. The Bollinger Bands and exponential moving average (EMA) are two indicators that can help clarify market trends by smoothing out technical charts to create trend signals.

0 kommentar(er)

0 kommentar(er)